Australia’s annual inflation rate rose in the 12 months to August 2023 to 5.2%, up from 4.9% in the 12 months to July 2023, with price rises in housing, transport, and insurance seeing the most significant price rises.

The data series, based on monthly readings of prices on a select sections of the economy, will likely keep the Reserve Bank of Australia on the lookout for price outbreaks and maintain their hawkish, yet cautious, footing on the official cash rate.

The RBA’s official cash rate is 4.10%.

Prices for Housing in Australia’s eight capital cities rose 6.6% during the period, while prices for transport were up 7.7% and insurance premiums up 8.8%.

Of major concern for the economy are global oil prices that are driving a return of Covid-level fuel prices. The monthly average cost of diesel jumping from 184.0 cents per litre in July to 211.6 cents per litre in August.

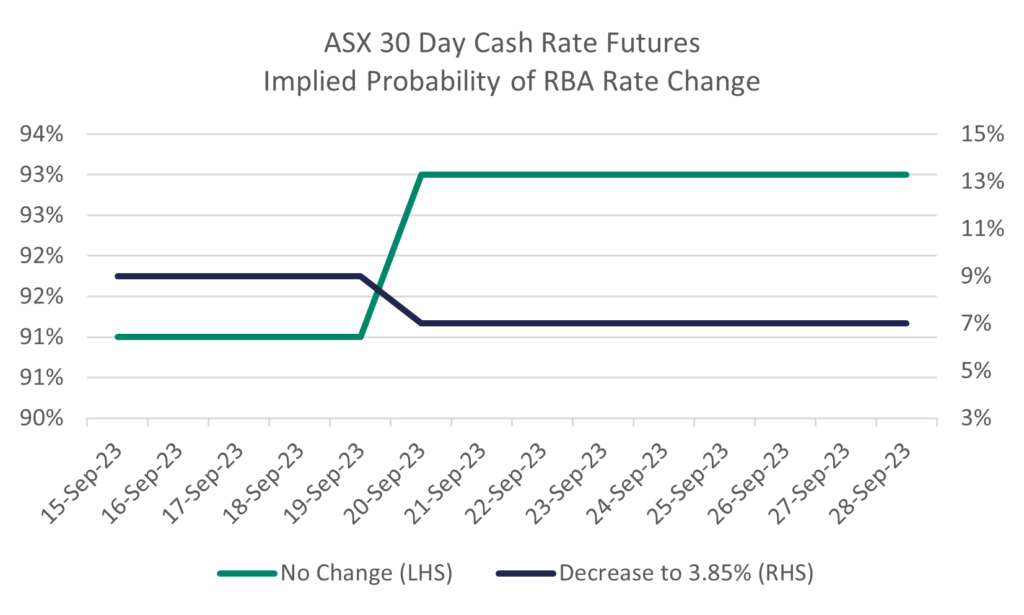

The Reserve Bank of Australia meets for the first time under the guidance of new governor, Michelle Bullock, on Tuesday, 3rd October. The market expects the RBA to remain on hold in October, as implied by pricing on ASX 30-Day Cash Rate Futures, but a 40% chance remains for November, 57% by December and 90% by March 2024. Most major banks expect the RBA to have already peaked.

Global concerns on inflation will also likely weigh on the central bank board’s mind. The yield for 10-Year US Treasury Bonds rose to a 16-year high during the past week to 4.64% on the back of higher oil prices and concerns for persistent inflation in service industry fees.

—

If you would like to discuss your current debt structure, interest rates, and business performance, or would simply like to explore more info about current economic conditions, please call 1300 002 286 or email info@catoadvisory.com.au.