Reduction in oil production from OPEC countries including Saudi Arabia and Russia recently pushed the price of a barrel of oil above US$95 with energy analysts expecting the price to exceed US$100 in the near future.

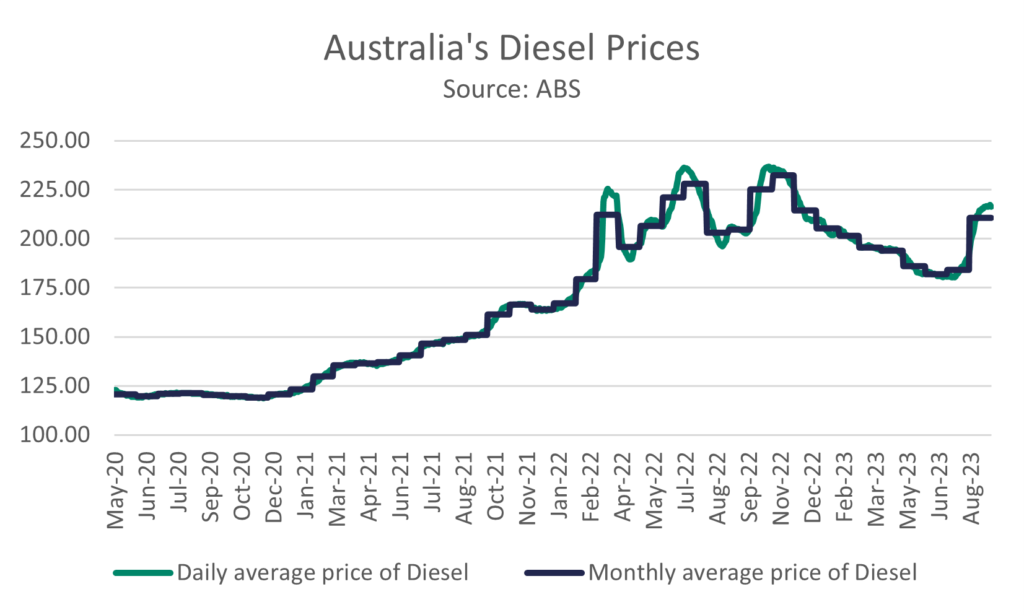

Australia’s agribusiness transport and industry sectors are copping the brunt of this stance from the world’s producers, with monthly average diesel prices back to above 210 cents per litre and daily averages exceeding 216 cents per litre, the highest since the end of 2022.

This comes at a tough time for agricultural enterprises with higher interest rates biting and weather conditions to get drier. The Bureau of Meteorology has declared El Nino conditions in place.

OPEC – the Saudi-led cartel that includes producers such as Russia – are reported to be withholding more than 5 million barrels of oil per day, or about 5% of global supply.

Gary Ross, chief executive of trading firm Black Gold Investors, told the AFR the Saudis are “starving the market of oil”, suggesting they are testing the market to find a price at which production will be increased.

Fuel prices across the economy are feeding into a persistent inflation story which the new governor of the Reserve Bank of Australia, Michelle Bullock, is expected to fight as hard as her predecessor.

Headline CPI rose 5.2% for the 12 months to August 2023 and while the RBA is not expected to move rates in October 2023, they remain poised to lift rates to curb further inflation.

The market is expecting no increase to the official cash rate in October, according to pricing on ASX 30-Day Cash Rate Futures, while the chance for an increase in December is 57% and 90% for March 2024.

—

If you’re concerned about interest rates and how they are impacting your business, please call 1300 002 286 or email info@catoadvisory.com.au