While interest rates across the banking sector have started to ease, many farmers relying on concessional funding through the Regional Investment Corporation (RIC) may be wondering why they’re not seeing the same benefit.

The RIC was a somewhat controversial policy initiative brought to life by colourful National Party member of parliament, Barnaby Joyce. Dubbed the ‘Barnaby Bank’, the RIC is a federal government agency established to provide supportive, long-term funding for Australia’s farmers at concessional interest rates.

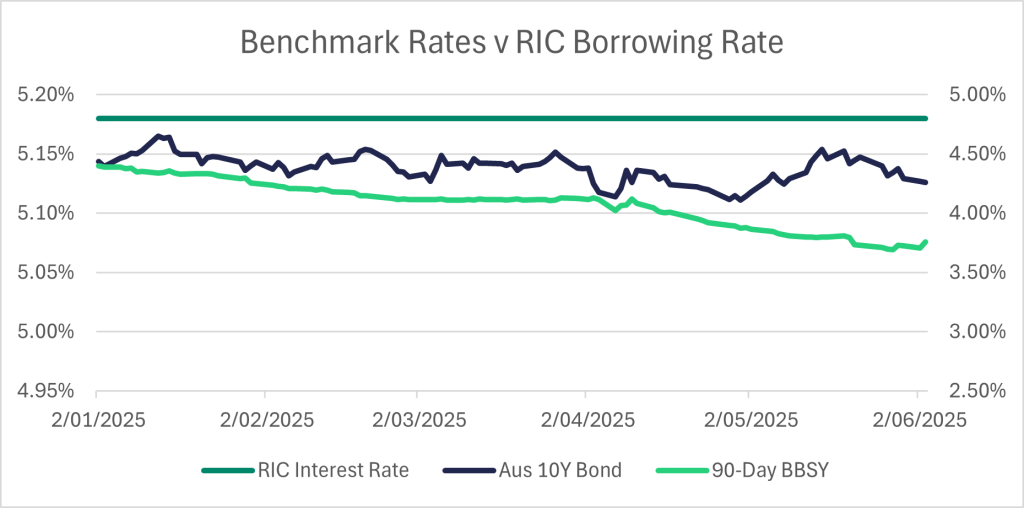

Unlike bank loans, which are typically priced off the short-term Bank Bill Swap Rate (BBSY), RIC concessional rates are based on the yield of Australian Government 10-year bonds, with a small margin charged on top for a return on investment for Canberra. When the RIC last updated its rate—lifting it to 5.18% in July 2024—the 10-year bond yield was 4.33%, the RBA cash rate was 4.35%, and the 90-day BBSY stood at 4.47%.

Today, those numbers have shifted. The RBA cash rate has fallen to 3.85%, and the 90-day BBSY has dropped more sharply to around 3.72% (as of 3 June 2025). The 10-year bond yield, however, sits stubbornly at 4.26%, only 7 basis points lower than July last year.

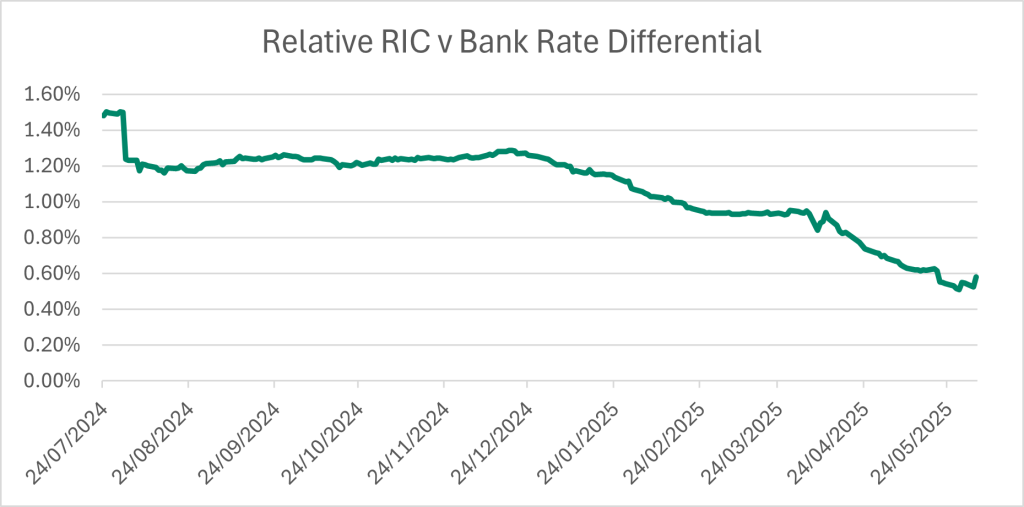

This change has squeezed the spread between concessional and commercial rates. What was once a wide gap in RIC’s favour has narrowed—prompting a timely question: Is RIC still the best fit for your debt mix?

That depends. RIC loans still offer meaningful value, particularly for long-term investment, restructuring, or succession. It’s akin to adopting an attractive fixed interest rate. But in a falling rate environment, locking in today may come at a cost.

The outlook for farm rates is positive. With softer data for the Australian economy being published, investors are increasing their bets that the Reserve Bank of Australia will cut rates again in July. Prices of ASX 30-Day Rate Futures imply an 86% chance of a cut in the July 2025 meeting.

If you’re unsure whether you, your family or your friends are getting the best rate, structure, or advice on your business finance, we’d love to chat. Check our our links below to make an appointment or learn about how we can save you money, time, an stress.